How to build credit without a credit card is a question many people ask, especially those who are just starting out, recovering from financial setbacks, or simply prefer to avoid credit cards. Fortunately, there are plenty of smart, practical ways to build and improve your credit score without ever swiping a card.

In this detailed guide, you’ll discover how to build credit without a credit card, using proven methods that lenders recognize and credit bureaus report.

Table of Contents

-

Why Credit Matters Even Without a Credit Card

-

Can You Build Credit Without a Credit Card?

-

9 Smart Ways to Build Credit Without a Credit Card

-

3.1 Get a Credit-Builder Loan

-

3.2 Report Rent Payments to Credit Bureaus

-

3.3 Use Experian Boost for Utility and Phone Payments

-

3.4 Become an Authorized User on Someone’s Account

-

3.5 Apply for a Credit-Builder Account from Your Bank

-

3.6 Use Personal Loans Responsibly

-

3.7 Finance a Car or Other Installment Loan

-

3.8 Pay Off Student Loans on Time

-

3.9 Build Savings to Support Future Credit Applications

-

-

Common Mistakes to Avoid

-

How Long Does It Take to Build Credit Without a Credit Card?

-

FAQs

-

Conclusion

1. Why Credit Matters Even Without a Credit Card

A strong credit score can:

-

Help you qualify for loans

-

Lower your car insurance premiums

-

Improve rental application success

-

Provide better job opportunities in some industries

So, learning how to build credit without a credit card is essential for financial stability—even if you never plan to use plastic.

2. Can You Build Credit Without a Credit Card?

Absolutely. While credit cards are a popular tool, they’re not the only way to demonstrate creditworthiness. Lenders, landlords, and even employers often check your credit, and non-card alternatives still contribute to your credit report.

Understanding how to build credit without a credit card simply means using other financial tools to prove your reliability.

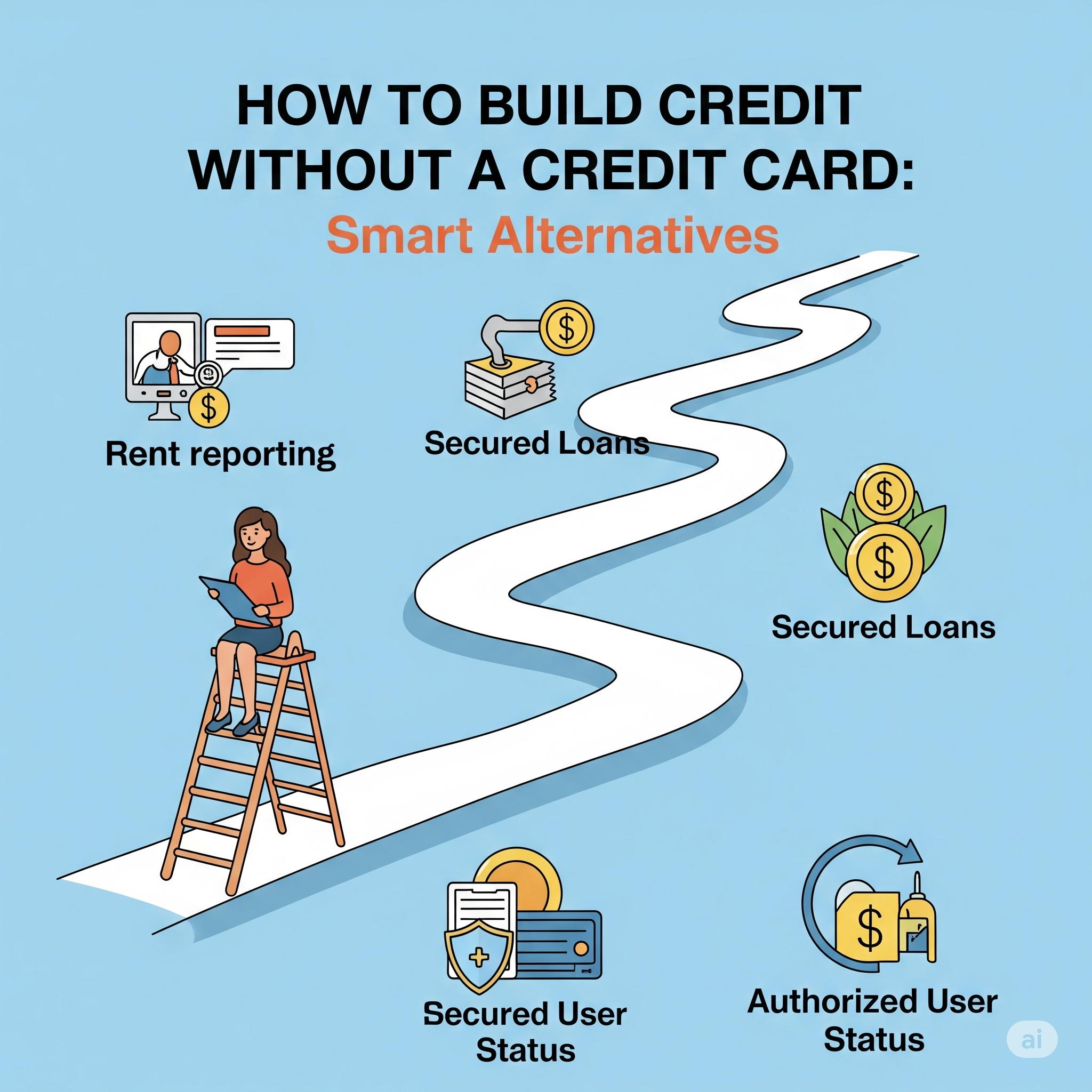

3. 9 Smart Ways to Build Credit Without a Credit Card

3.1 Get a Credit-Builder Loan

A credit-builder loan is designed specifically to help people establish or rebuild credit.

How it works:

-

You borrow a small amount (typically $300–$1,000).

-

The money is held in a secured account.

-

You make fixed monthly payments.

-

At the end of the loan term, you get the funds back.

These payments are reported to all three major credit bureaus, making it an effective method for anyone asking how to build credit without a credit card.

Recommended Lenders:

-

Local credit unions

3.2 Report Rent Payments to Credit Bureaus

Most landlords don’t report rent payments, but you can change that. Services like:

…can report your on-time rent payments to TransUnion and Equifax.

If you consistently pay rent, this is an excellent strategy for how to build credit without a credit card.

3.3 Use Experian Boost for Utility and Phone Payments

Experian Boost allows you to add:

-

Phone bills

-

Utility bills

-

Streaming service payments

…directly to your Experian credit report.

This free tool gives many users an immediate credit score boost, making it a quick way to tackle how to build credit without a credit card.

3.4 Become an Authorized User on Someone’s Account

A trusted family member or friend can add you as an authorized user to their credit card.

Benefits:

-

Their positive payment history appears on your credit report.

-

You don’t have to use the card yourself.

It’s a common, low-risk strategy for anyone learning how to build credit without a credit card.

3.5 Apply for a Credit-Builder Account from Your Bank

Many banks and credit unions offer special savings accounts or small loans aimed at building credit.

Check with your financial institution for:

-

Credit-builder savings plans

-

Secured loans with flexible terms

These tools work similarly to credit-builder loans but may offer lower fees or better terms.

3.6 Use Personal Loans Responsibly

If you qualify, a small personal loan can help build credit. The key is:

-

Only borrow what you can repay

-

Make all payments on time

Installment loans like these diversify your credit mix, helping you build credit even without a credit card.

3.7 Finance a Car or Other Installment Loan

Auto loans or other secured installment loans can boost your credit score if managed properly.

Important:

-

Make timely payments

-

Avoid borrowing more than necessary

-

Consider refinancing for better rates once your credit improves

For those wondering how to build credit without a credit card, an auto loan is a practical solution—just ensure affordability.

3.8 Pay Off Student Loans on Time

If you have student loans, they already contribute to your credit file. On-time payments help you build a solid credit history without credit cards.

If you’re still in school or in deferment, interest may still accrue, so managing these loans wisely is key.

3.9 Build Savings to Support Future Credit Applications

Having savings won’t directly appear on your credit report, but:

-

It improves your overall financial profile

-

It increases approval odds for loans

-

It reduces the need for risky borrowing

Good savings habits complement all strategies for how to build credit without a credit card.

4. Common Mistakes to Avoid

When trying to build credit without a credit card, steer clear of:

-

Payday loans (they don’t report to credit bureaus)

-

Co-signing for risky borrowers

-

Missing payments on loans or bills

-

Applying for too many loans at once

Building credit takes patience—quick fixes or shortcuts often backfire.

5. How Long Does It Take to Build Credit Without a Credit Card?

Results vary, but generally:

-

Within 3 to 6 months, you may establish your first credit score.

-

After 12 months of on-time payments, your score strengthens significantly.

-

The longer your positive history, the better your score.

Consistency is the key to success in how to build credit without a credit card.

6. FAQs

Is it harder to build credit without a credit card?

It can take more planning, but it’s absolutely achievable with alternative credit-building tools.

Will rent payments always help my credit?

Only if reported through services like RentReporters or LevelCredit—traditional landlords often don’t report rent history.

Can I build excellent credit without ever using a credit card?

Yes, though having a mix of credit types—including installment loans—helps maximize your score.

Does Experian Boost work instantly?

Many users see immediate score improvements after connecting utility and phone accounts.

7. Conclusion

Understanding how to build credit without a credit card empowers you to take control of your financial future—even if you prefer to avoid credit cards altogether.

By using tools like credit-builder loans, reporting rent, leveraging Experian Boost, and making on-time payments on installment loans, you can build a strong, healthy credit profile.

Remember, building credit takes time and consistency, but the rewards—better interest rates, easier loan approvals, and more financial freedom—are worth the effort.

Internal Links:

-

Best credit-builder loans in 2025

-

How to report rent to credit bureaus

-

Credit repair tips for beginners

DoFollow External Links:

Good day! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting fed up of WordPress because I’ve had problems with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.