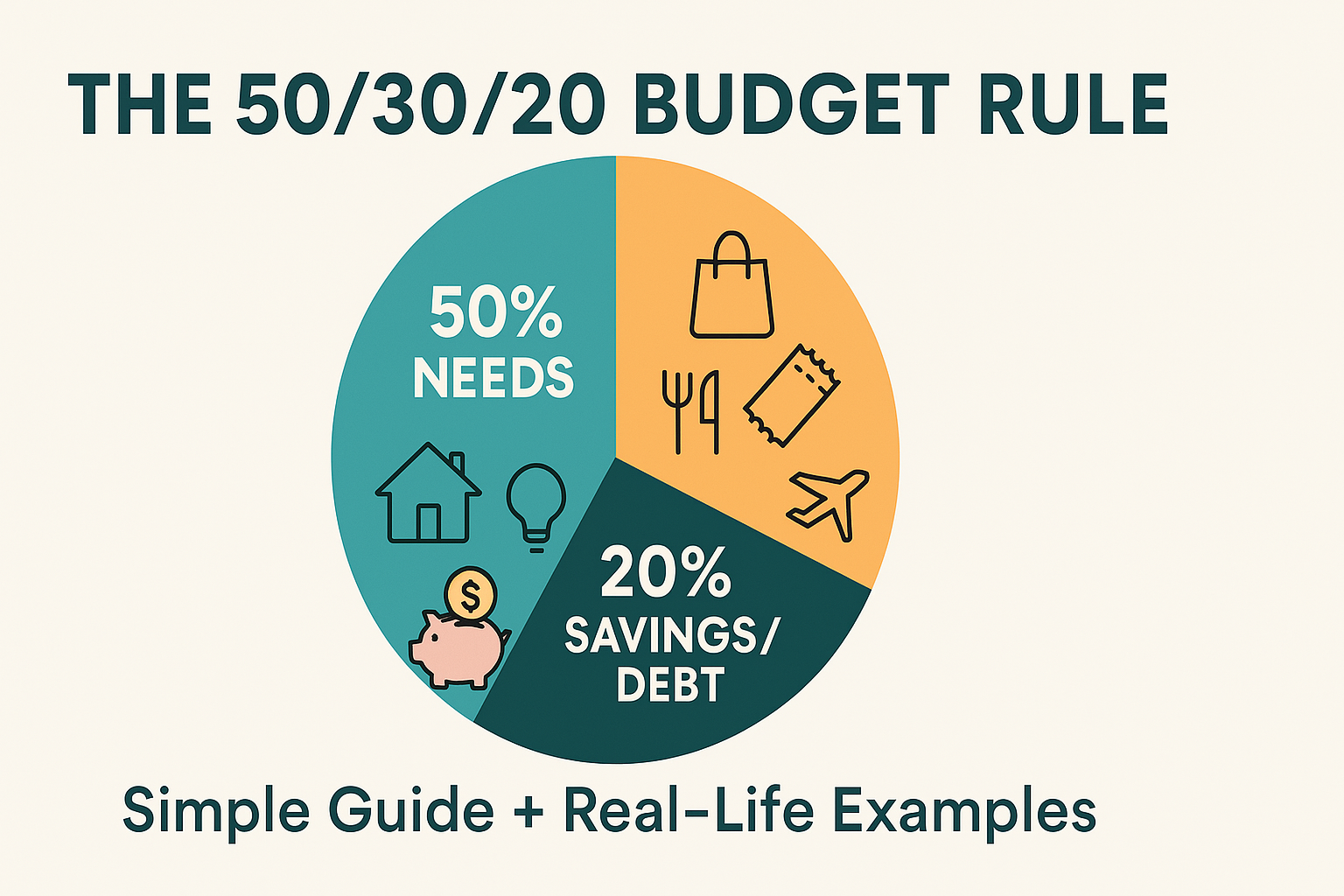

Understanding and managing your finances is crucial for achieving long-term financial stability. One effective strategy to guide your spending and savings is the 50/30/20 budget rule. This method offers a straightforward framework to allocate your after-tax income into three distinct categories: needs, wants, and savings. Henrico HRForbes+6 IInvestopedia + 6 Ruby+ Tuesday + 6

What Is the 50/30/20 Budget Rule?

The 50/30/20 rule divides your after-tax income as follows: Ruby Tuesday + 1 Investopedia+1

-

50% for Needs: Essential expenses necessary for basic living. Voya 3Empower + 3SELF + 3

-

30% for Wants: Non-essential items that enhance your lifestyle. SELF+3 Business Insider + 3 EarnIn+3

-

20% for Savings and Debt Repayment: Funds allocated towards savings, investments, and paying off debts. A+ Federal Credit Union + 2 Henrico HR+2 Western & Southern + 2

This budgeting approach was popularized by U.S. Senator Elizabeth Warren in her book, “All Your Worth: The Ultimate Lifetime Money Plan”.” nvestopedia

Breaking Down the Categories

-

Needs (50%)

These are expenses you must pay to maintain a basic standard of living. They include:

-

Housing (rent or mortgage payments)

-

Utilities (electricity, water, gas)

-

Groceries Tuesday + 17 Investopedia+17 Henrico HR+17

-

Transportation (car payments, public transit)

-

Insurance (health, auto, home) EarnIn+12Investopedia+12San Francisco Chronicle+12

-

Minimum debt payments

It’s important to distinguish between needs and wants; for example, a basic car is a need, while a luxury car falls into the wants category.

-

-

Wants (30%)

Wants are non-essential items or services that enhance your quality of life. Examples include:

-

Dining out

-

Entertainment (movies, concerts)

-

VacationsEarnIn

-

Subscription services (streaming platforms, magazines)

While these expenses are not essential, they play a role in making life enjoyable. Allocating funds for wants ensures you can indulge occasionally without compromising your financial health.

-

-

Savings and Debt Repayment (20%)

This portion is dedicated to strengthening your financial future. It includes:

-

Building an emergency fundalwahidaismail.com+9Bedel Financial+9Henrico HR+9

-

Contributing to retirement accounts (e.g., 401(k), IRA)

-

Investing in stocks, bonds, or other assets

-

Paying off debts beyond the minimum payments

Prioritizing this category helps in creating a safety net and achieving long-term financial goals.

-

Real-Life Example

Let’s consider a practical scenario:

-

Monthly After-Tax Income: $4,000

Applying the 50/30/20 Rule: Worksheets Printable

-

Needs (50%): $2,000

-

Wants (30%): $1,200

-

Savings and Debt Repayment (20%): $800 Western & Southern

This allocation provides a clear guideline on how to distribute your income effectively. However, it’s essential to adjust these percentages based on individual circumstances. For instance, if your essential expenses exceed 50%, you may need to reduce spending in the wants category or increase your income.

Benefits of the 50/30/20 Rule

-

Simplicity: The rule offers a straightforward framework that’s easy to follow and implement.

-

Flexibility: It can be adjusted to fit various income levels and financial situations.

-

Balanced Approach: Ensures that essential needs are met while also allowing for discretionary spending and savings.

Considerations and Adjustments

While the 50/30/20 rule serves as a helpful guideline, it’s not a one-size-fits-all solution. Factors such as high living costs in certain areas, existing debt levels, and personal financial goals may necessitate adjustments. It’s crucial to assess your unique situation and modify the allocations to better suit your needs.

In conclusion, the 50/30/20 budget rule is a valuable tool for managing your finances, promoting a balanced approach to spending and saving. By understanding and applying this rule, you can work towards achieving financial stability and reaching your long-term financial objectives.